Workers’ compensation insurance for sports and fitness businesses

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers’ comp protects employees at your sports and fitness business

Teaching sports and fitness always involves physical risk. If an instructor at your yoga studio sprains a muscle, or a personal trainer develops a work-related back injury and requires surgery, your business could end up responsible for the medical bills.

Workers’ compensation insurance can pay for an injured worker's medical expenses as well as partial missed wages.

Workers’ compensation can help pay for an injured employee’s:

- Immediate medical costs, such as emergency room expenses

- Disability benefits while the employee is recovering

- Ongoing medical costs, such as physical rehabilitation

Workers’ comp protects sports and fitness business owners

Typically included in a workers’ comp policy, employer’s liability insurance provides protection when an employee decides to sue a business owner over a work-related injury.

Employer’s liability insurance can help cover:

- Attorney’s fees

- Court costs

- Settlements and judgments

Even if a lawsuit is found to be without merit, you could find yourself paying for a costly legal defense if not properly insured.

How is workers' comp calculated for sports and fitness businesses?

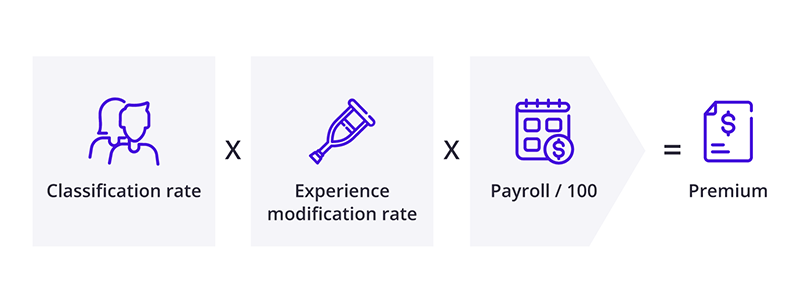

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers’ comp requirements for sports and fitness businesses

Each state has its own laws for workers’ compensation requirements. For example, every fitness business in New York must carry workers’ compensation insurance for its employees – even a single part-time worker. However, business owners in Alabama are only required to carry workers’ compensation when they have five or more employees.

Sole proprietors, independent contractors, and partners don’t have to carry workers’ compensation insurance, but you can purchase this policy to protect yourself, too. It's a good idea to carry this coverage, as health insurance can deny claims for injuries related to your job.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, sports and fitness businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Lower workers’ comp costs with risk management

Sports and fitness professionals are at high risk for injuries. If a sports coach or instructor is injured on the job, it can lead to an insurance claim, which will most likely bump up your workers' comp premium.

At any fitness business, you can mitigate risks. For example, you can create a safer work environment with:

- Employee safety training

- Regular maintenance of exercise equipment

- Regulations that enforce proper footwear

Taking these steps should reduce workplace injuries, which can result in lower insurance premiums.

Top fitness professionals we insure

Don't see your profession? Don't worry. We insure most businesses.

How much does workers' comp for sports and fitness businesses cost?

Sports and fitness businesses pay an average of $75 per month for workers' comp insurance, but you could pay more or less depending on your risks.

Insurance costs for sports and fitness professionals are based on a few factors, including:

- Sports and fitness services offered, such as group fitness classes

- Business equipment and property

- Revenue

- Location

- Number of employees

Other important policies for fitness professionals

Workers’ compensation insurance offers protection for your employees and to some extent your business, but it doesn’t provide coverage for many common risks. Sports and fitness business owners should also consider:

General liability insurance: This policy covers expenses related to customer injuries and property damage. It also covers advertising injuries, such as an accusation of slander from a competitor.

Business owner's policy (BOP): This policy bundles general liability coverage with commercial property insurance, often at a lower premium than if the policies were purchased separately.

Professional liability insurance: This policy covers legal expenses related to work mistakes, such as a client injury caused by improper training. It's also called errors and omissions insurance or E&O.

Commercial auto insurance: This policy covers the cost of an accident involving your work vehicle. State laws determine how much auto liability insurance you need.

Cyber insurance: This policy helps fitness businesses recover financially from data breaches and cyberattacks. It's recommended for any business that stores customer information.

Get free quotes and buy online with Insureon

Are you ready to safeguard your sports and fitness business with workers’ compensation or another type of insurance? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage in less than 24 hours.